It has been a short week but President Trump has dominated most of it . . triggering a lighthearted moment of relief and amusement with a twitter typo (“covfefe”) which moved to international rebuke when he announced his decision to withdraw from the Paris Climate Accord on Thursday.

So we lurched from the ridiculous to the existential, and press coverage could barely keep up. Markets barely missed a beat though, as data showed that the jobless rate had hit its lowest level in 16 years but the hiring pace had slowed – suggesting that in some areas there might actually be a shortage of labor. There was some discussion that this robust data would influence the Fed more than the inflation rate when it comes to increasing rates in the belief that stronger economic activity would ultimately drive inflation.

May market performance was strong in the US, with the S&P 500 up 1.4%, while financials fell by 1.2% on poor earnings and the May 17 Comey wobble. European markets were strong, particularly in peripherals (Greece, Italy, Portugal), while the UK FTSE rose by close to 5% despite the terrorist attack there on May 22 and the likelihood that the upcoming election will be tighter than anticipated

The dollar fell by 3% v. the Euro over the month, reflecting greater optimism regarding European prospects. Oil had a negative month (losing 2-3%, bringing the wear to date drop to between 10% and 13%) while other commodities were mixed.

Interestingly bonds had another strong month, particularly in Emerging Markets, despite the woes affecting Brazil’s equity market (-4.1%).

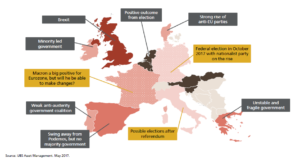

The chart above is an interesting one presented by one of our managers UBS. It illustrates that despite the near misses in terms of populist insurgence at recent elections that there is still considerable uncertainty in the direction of politics across Europe. While the continent looks a little bit off “breaking point” after the recent results there still remains a lot to play for in terms of controlling the narrative. I am presenting this chart here as a counterpoint to the unbridled optimism that seems to be circulating around Europe currently.