July saw global markets continue their ascent, although momentum was negative for the USD. The S&P rose by 2.1%, led by financials and tech stocks, while in Europe financials dominated, rising by 2.7% in Euro terms (DJ Stoxx 600 Banks). The FTSE was also strong despite a rise in Sterling (+0.9%), but peripherals had a more muted month, with the exception of Italy (the FTSE MIB rose by 4.6%). Emerging Markets saw a classic “straight up” month, with the overall index rising 6% in dollar terms, drawing on local currency returns from the Shanghai Composite of 3.7%, the Bovespa of 4.8% and the NIFTY of 6.1%.

Following the swoon in performance over the second quarter, oil was a strong performer, increasing between 8-9%. This led the CRB commodities index to be 4.5% higher on the month (although it remains -5% for the year). Copper has performed strongly year to date (+15.4%, +7.1% in July), as has Gold (now +10% year to date, +2% in July), perhaps reflecting the weakness in the dollar.

The weaker dollar is also increasing the pressure on US corporate bond spreads, which are hovering close to their lowest level since 2014. Flows into US bond funds, both from domestic as well as international investors are at very robust levels, with more than $130 bn added this year. Corporate issuances are seeing robust demand too, with large issues often oversubscribed and at favorable pricing for issuers. These metrics might support an opinion we recently heard voiced by one of our equity managers – when asked whether he believed equity markets were in “bubble” territory he responded that he was actually more attributing that term to fixed income today. Overall bonds have continued to perform strongly, with US high yield firmly in recovery mode (+5.6% ytd, +1.1% in July), although government bonds have been more or less flat (with the exception of Treasuries, +2.1% ytd).

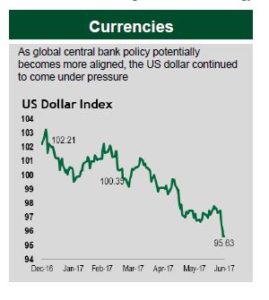

The gainers against the dollar were the Euro (+12.3% for the year, following a rise of 3.4% in July), Sterling (up 7% ytd) and the Yen (up 6% ytd), the AUD (+10.7% ytd) and the CAD (7.6% ytd). This begs the question as to where markets are factoring in the Fed’s early adoption of a tightening policy, whereas for now other Central Banks are “all talk”. One theory is that markets have long ago discounted in an early move by the Fed, which in fact contributed to the sustained dollar rise in recent years. Now that the flatter yield curve has seemed to put a limit on this trajectory markets may be less enthused and hunting elsewhere for the next movers (see below). A key question is whether this move has been overdone to the downside and will correct a little in the second half of the year, or will continue in a downwards motion. The relative strength and soundness of US data would suggest that some support should be forthcoming.

Source: Manulife